ARTICLES

UMBA Loan App Review in Nigeria: Interest Rates, Repayment Calculator, Advantages and Risks

UMBA Loan App Review in Nigeria: Interest Rates, Repayment Calculator, Advantages and Risks

UMBA Loan App Review – What You Must Know Before Borrowing

In today’s Nigeria, quick access to loans has become a lifeline for many families, business owners, and salary earners. With rising costs of living, people are searching for fast online loans in Nigeria without collateral. Among the many mobile loan platforms, UMBA Loan App stands out because it is licensed by the Central Bank of Nigeria (CBN), making it safer than unregulated lenders.

But there’s a catch—the interest rate is very high.

Before rushing to borrow, let’s carefully analyze UMBA’s loan structure, calculate real repayment examples, and weigh the benefits and disadvantages. This will help you decide if UMBA is worth your time or if you should consider cheaper loan alternatives.

How UMBA Loan Works

UMBA offers instant personal loans through its mobile app. The entire process is digital, requiring no collateral, guarantors, or paperwork. Once you download the UMBA app and complete registration, you can apply for a loan and get funds disbursed to your bank account within minutes.

Unlike many unregulated loan apps that send threatening messages to your contacts, UMBA is CBN-approved and follows proper data protection rules. This is a big relief for borrowers who fear embarrassment.

UMBA Loan Interest Rate – Real Calculation

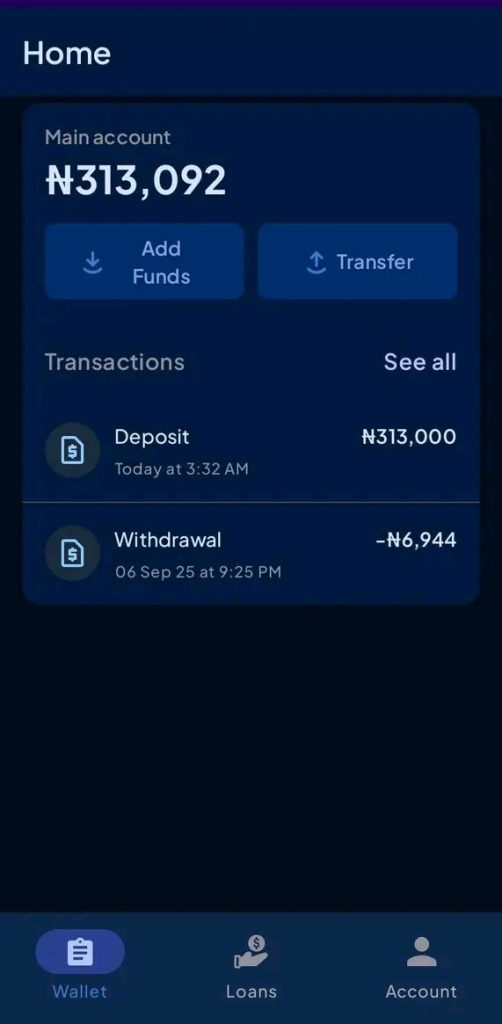

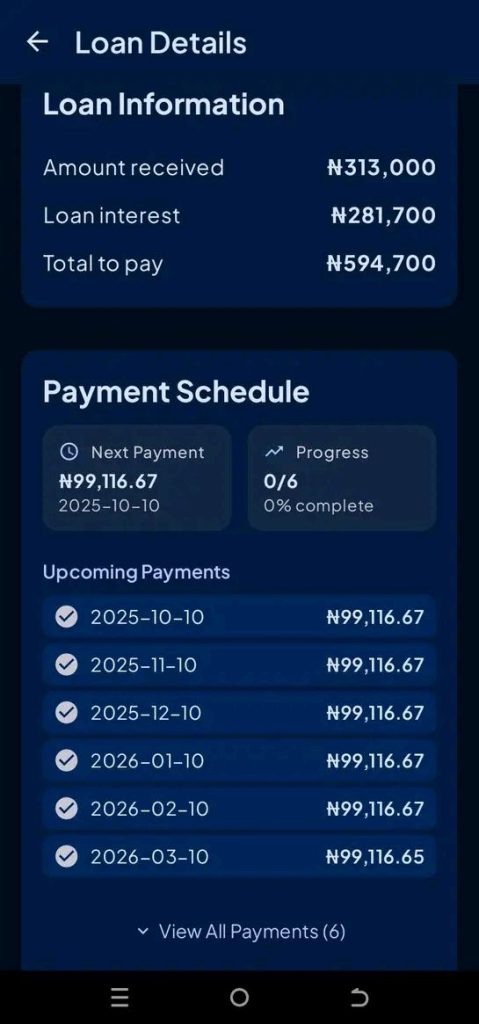

Now, let’s get practical. If you borrow ₦313,092, UMBA expects you to pay back ₦594,700 within six months.

Here’s the breakdown:

- Total Interest Paid = ₦594,700 – ₦313,092 = ₦281,608

- Interest Rate = (₦281,608 ÷ ₦313,092) × 100 ≈ 89.9%

That means UMBA charges almost 90% interest in just six months. Compared to commercial banks that may charge between 15–25% annually, this is extremely high.

UMBA Loan Calculator: Repayment Estimates

To help you plan better, let’s calculate how much you’ll pay back on different loan amounts using UMBA’s ~90% six-month interest rate:

- ₦50,000 loan → Pay back ≈ ₦95,000

- ₦100,000 loan → Pay back ≈ ₦190,000

- ₦200,000 loan → Pay back ≈ ₦380,000

- ₦500,000 loan → Pay back ≈ ₦950,000

This shows that while UMBA offers instant cash loans in Nigeria, repayment is almost double the borrowed amount within six months.

Advantages of UMBA Loan App

Despite the high interest, UMBA has some strong advantages:

- Licensed by CBN – Safer and more reliable than unregulated loan apps.

- Instant Loan Approval – No delays; funds are credited quickly.

- No Collateral Required – You don’t need land documents, guarantors, or paperwork.

- Transparent Charges – No hidden deductions or extra fees.

- No Harassment – UMBA does not defame borrowers or call their contacts.

- Good for Emergencies – Perfect for medical bills, urgent business needs, or family support.

Disadvantages of UMBA Loan App

On the other hand, borrowers should be cautious of the downsides:

- Very High Interest Rate – Nearly 90% in six months.

- Short Repayment Period – You must repay quickly, which may pressure your finances.

- Not Ideal for Large Loans – Borrowing ₦500k and paying back almost ₦1m can be overwhelming.

Who Should Use UMBA Loan App?

- If you need urgent cash and have a clear repayment plan, UMBA is a reliable choice.

- If you are looking for long-term affordable loans, you might be better off with bank loans, salary-backed loans, or microfinance institutions that offer lower interest.

Final Verdict – Is UMBA Loan App Worth It?

UMBA Loan App is one of the few CBN-licensed digital lenders in Nigeria, making it far safer than many anonymous apps. It is fast, transparent, and user-friendly. However, the interest rate is extremely high, almost doubling your debt in just six months.

For short-term emergency loans, UMBA can be a solution. But for larger or long-term financial needs, you may want to compare other loan apps with lower interest rates in Nigeria before making a decision.

Frequently Asked Questions About UMBA Loan App

Is UMBA Loan App approved by CBN?

Yes. UMBA is fully licensed by the Central Bank of Nigeria, making it one of the few regulated loan apps in the country.

What is UMBA’s interest rate?

UMBA charges close to 90% interest within six months, which is very high compared to banks and microfinance institutions.

How much can I borrow from UMBA?

Loan amounts vary based on your credit score and repayment history. Users can borrow from as little as ₦10,000 up to ₦500,000 or more.

Does UMBA have hidden charges?

No. UMBA states that there are no hidden fees or extra charges apart from the interest rate applied.

Does UMBA call or harass contacts?

No. Unlike unregulated loan apps, UMBA does not harass or defame borrowers by calling their contacts.

How can I reduce my interest on UMBA loan?

The best way is to borrow only what you can repay early. Clearing your loan before the due date helps maintain a good record and can increase your loan limit.

Is UMBA good for business loans?

UMBA is more suitable for short-term personal or emergency loans. For business expansion, you may need more affordable long-term financing options.

Discover more from 9jaPolyTv

Subscribe to get the latest posts sent to your email.

ARTICLES13 hours ago

ARTICLES13 hours agoHow to Get Mortgage Loans in Nigeria: Home Financing Made Simple

ARTICLES13 hours ago

ARTICLES13 hours agoCar Loans and Auto Financing in Nigeria: How to Buy a Vehicle Without Full Payment

ARTICLES13 hours ago

ARTICLES13 hours agoTop Personal Loan Options for Salary Earners in Nigeria Without Stress

ARTICLES12 hours ago

ARTICLES12 hours agoGovernment Intervention Loans in Nigeria: CBN and BOI Funding Options You Can Apply For

POLYTECHNIC NEWS23 hours ago

POLYTECHNIC NEWS23 hours ago4 Years in Polytechnic + 1 Year NYSC = Total Waste of Time? Twitter User Sparks Hot Debate Among Nigerian Youths

ARTICLES12 hours ago

ARTICLES12 hours agoBusiness Expansion Loans in Nigeria: Funding Options for Growing Companies

ARTICLES12 hours ago

ARTICLES12 hours agoWedding Loans in Nigeria: How Couples Can Finance Their Big Day

ARTICLES12 hours ago

ARTICLES12 hours agoAgricultural Loans for Farmers in Nigeria: How to Finance Livestock and Crop Farming